About Us

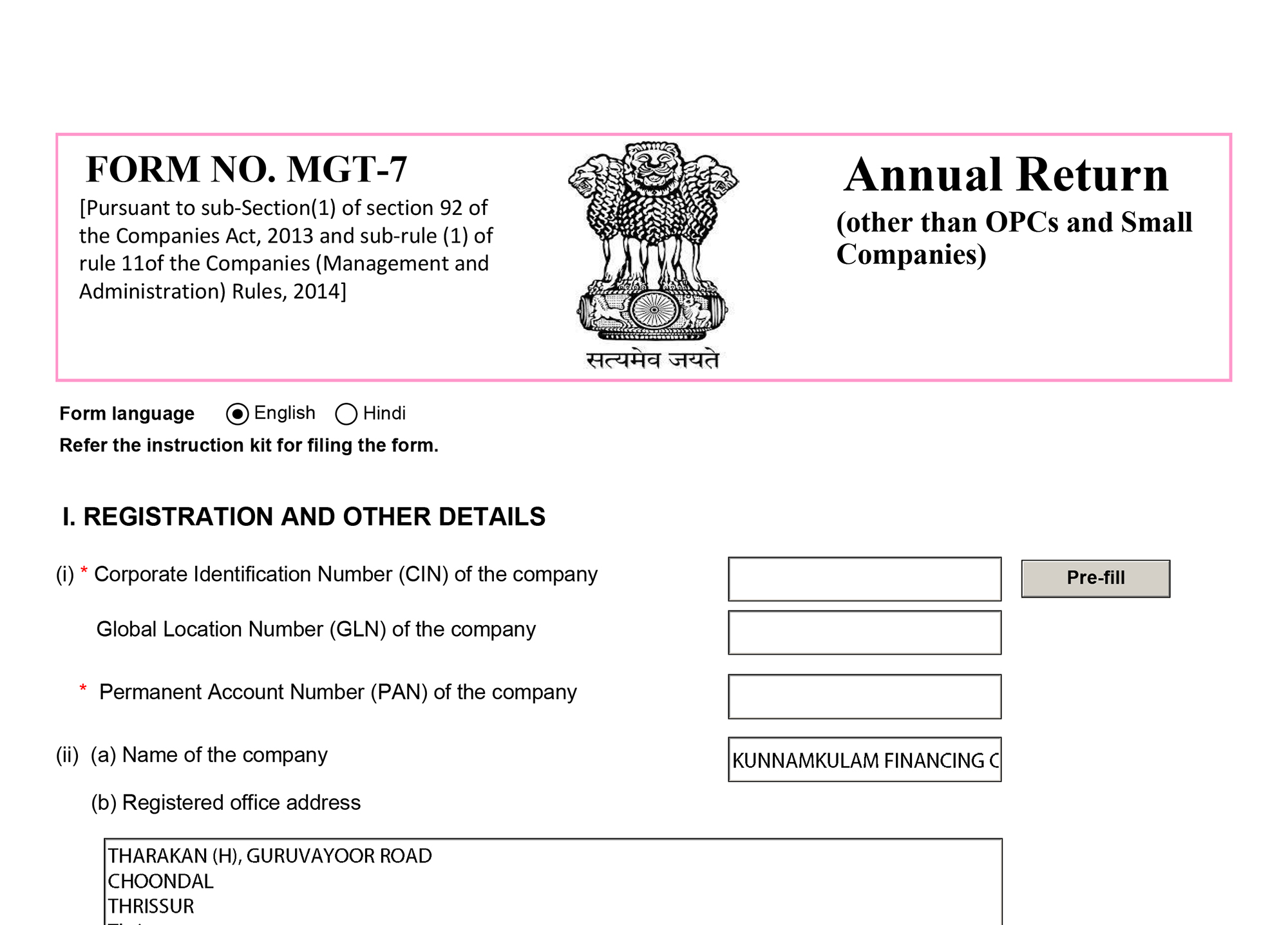

Kunnamkulam Financing Co. LTD

Door No.: 1/211.B, THARAKAN ARCADE, GURUVAYOOR Road, Choondal Post, Pin - 680502.

In most regions of the world, access to official banking channels for funding is becoming constricted. International traders are often facing the issue of having arranged the trade, but being unable to arrange the required funding.

We step into such situations and arrange the funding that enables you to complete the trade. We are an alternative source of finance to banks and offer funding that is competitive in rates, responsive in terms of the opportunity and flexible when it comes to the structure.

We believe in powering trade through structured funding, enabling business to grow and capture profits from every opportunity.

“RESOLVED THAT”, to adopt the Fair Practices Code as prescribed by RBI as given under and authorize Managing Director to implement the Fair Practices code after the grant of Certificate of Registration from Reserve Bank of India.

In pursuance of various Circulars as summarised vide Master Circular issued vide DNBS (PD) CC No. 340/03.10.042/2013-14 by the Reserve Bank of India the following Fair Practice Code has been approved by the Board of Directors of M/s. Kunnamkulam Financing Company Limited at the meeting held on 04th June, 2014.

We believe in powering trade through structured funding

Enabling business to grow and capture profits from every opportunity.

Loan Application and processing

1. Every loan will be processed on the basis of the application in vernacular language submitted by the prospective borrowers in printed form available with the company. Terms and condition of the loan such as rate of interest, service charges, mode of repayment, repayment schedule, penal interest, prepayment charges if any etc should be mentioned clearly so that the borrower is given a reasonable opportunity for comparison of the terms and conditions with other NBFCS or other agencies engaged in financing. Application will contain the list of documents to be accompanied with application which are essential for sanctioning/consideration of the company.

2. Applicant will be given a receipt mentioning the possible process time required for the sanction or rejection unless the loan is provided on the same day.

3. The decision of the company will be informed to the applicant directly, by letter,phone or email in case of rejection.

Sanction of loan

A formal sanction letter will be issued to every applicant giving the terms and conditions of sanction, documents to be executed, repayment schedule indicating clearly the periodical repayments, interest, hire charges, service charges, penal interest and prepayments charges if any. The terms and conditions of the sanction will be communicated to the borrower and the company will obtain the concurrence of the borrower by getting his signature on the copy of the sanction letter or sanction card before the disbursal of loans.

Disbursements of loans

Loans will be disbursed by cash or cheque or DD as per the request of the borrower at the discretion of the company. Company will maintain a register of all loans disbursed by it.

Changes in terms and conditions

1. All changes of the sanction conditions which has an adverse effect on the borrower will be made only prospectively and as per the terms of the agreement.

2. Decisions to recall or accelerate payment or performance will be in consonance with the agreement.

Monitoring of repayments

Company will periodically monitor the repayment of loan as per the sanction condition and remind the borrower about the over due

amount to be remitted to clear dues.

Method of recovery

1. Company shall not employ unethical practice like harassment, cohesion, intimidation, odd hour enquiry or muscle power to facilitate repayments in case of over due installments or repayments. Company shall only resort legal or costumer friendly methods for recovery of loan.

2. Under no circumstances company will interfere in the affairs of the borrower except to the extent provided in the agreement.

3. Company shall not out source its right of recovery or engage other agency to recover the dues from the borrowers.

Transfer of loans

All request received from the borrowers for transfer of loans will be considered by the company within 15 days of the receipt of such request.

Closure of loan

Company will release or cancel all securities, agreements, lien or HP noting obtained from the borrower on closure of the loan except the same are to be kept in the custody of the company in the event if the borrower has given guarantee for any other loan given by the company. Company can retain the copies of the cancelled documents which are required to be kept in the record for future reference or submission to authorities.

Grievance Redressal

Borrower has the right to represent for the redressal of his genuine grievances and disputes. Company shall appoint a responsible Grievance Redressal Officer who will look into the grievances and disputes between the company and the borrower. The name and contact details of the officer concerned will be displayed at all offices of the company, its web site and in the sanction order or sanction card for the information and reference of the borrower. Complaint received from the borrower will be examined and disposed within 30 days of its receipt. If the grievance is not settled properly the borrower is free to approach the Officer in Charge, DNBS, Reserve Bank of India whose details is displaced at the offices of the company. Company shall maintain a register to record all grievances received from the borrowers mentioning the action taken on the same. Board of directors of the company shall review the periodical report submitted by the officer concerned.

Unsecured loans

1. Company will obtain an application in vernacular language form the prospective borrower for availing unsecured loans which will contain the terms of repayment, rate of interest and documents to be executed by the borrower in favor of the company. Company is charging interest on loan varying from 15% to 18% per annum.

2. Company will issue a loan sanction letter showing the terms of repayment, rate of interest and documents such as promissory note to be executed by the borrower.

3. Company may collect from the borrower the details of assets owned by the borrower to take necessary legal action in the event of default.

4. Company will also insist periodical confirmation from the borrower to keep the unsecured loan alive from time barring.

Hire Purchase

1. Company shall ensure that the vehicle is owned or acquiring by the borrower. A proper hire purchase agreement shall be executed for all hire purchase advances and lien in favor of the company is noted with the concerned registering authority. If the agreement is not in vernacular language its contents should be explained to borrower so that he is fully aware of the terms and conditions upon which he is availing the facility.

2. Company shall ensure that taxes, insurance, permits, other test certificates, license of the driver of the vehicle are up to date, remind the borrower the due dates of renewal and in the event of non-compliance remit or take necessary action from its side to ensure compliance. Periodical inspection as per the sanction be conducted by the authorized officials of the company to assess the conditions of the vehicle.

3. Hire Purchase Agreement will have a clause regarding repossession of the vehicles financed by the company which essentially contain (i) notice period before taking possession; (ii) circumstances under which notice period can be waived; (iii) the procedure for taking repossession; (iv) final chance of borrower for repayment of loan before sale / auction of the security; (v) procedure for giving repossession to the borrower; (vi) procedure for sale/auction of the security.

Gold loans

1. Company will adhere the LTV ratio prescribed by the RBI from time to time while providing gold loans.

2. . Company will obtain a declaration from the borrower that the gold given in the custody of the company is owned by the borrower.

3. Company will appoint an experienced assayer to assess the quality of the gold pledged by the borrower.

4. Proper facility to keep the safe custody of the gold pledged by the borrowers is in place at both offices of the company. Adequate insurance cover is being be taken by the company for loss of gold by theft, fire, natural calamities etc.

5. In the event of default, gold pledged with the company will be auctioned only after the period mentioned in the sanction card or pawn ticket. Borrower will be given sufficient notice regarding the auction. Auction notice will be published in 2 newspapers, one in vernacular language and another in national daily. Auction will be held through auctioneers approved the board of directors of the company and the company will not participate in the auction.

Grievances:

Sri. Kuriappan T. T., Director of the Company is the Grievance Redressal Officer under the Fair Practices Code who can be approached by the public for resolution of complaints against the Company in the below mentioned address:

Kunnamkulam Financing Co. LTD

Door No.: 1/211.B

THARAKAN ARCADE

GURUVAYOOR Road

Choondal Post, Pin - 680502.

Tel No. 04885 236271, Mobile: 09605958272

If the grievance/dispute is not settled properly within 30 days, the borrower is free to approach the Officer in Charge, Department of Non-Banking Supervision, Reserve Bank of India, Bakery Junction, PB No. 6507, Thiruvanthapuram – 695033, Kerala, Tel No. 0471 2338818, under whose jurisdiction the registered office of the Company falls.

For M/s. Kunnamkulam Financing Company Limited

Need a custom service or plan to boost up your business ?

BOARD OF DIRECTORS

hard working people behind the scene

P.K.VIJAYAN

Managing Director

SHINY JOSEPH

Director

JOJU THARAKAN

Director

JIJU THARAKAN

Director